Introduction

When diversity becomes the main hiring reason for a role as complex as the global CEO of Starbucks, we can be prepared for a disaster.

Proof? The disastrous 17-month tenure of former CEO Laxman Narasimhan is an example of what happens when actual business skills, hands-on experience, and market understanding are overshadowed by optics, arrogance, and consulting credentials.

Today, let’s dive into some of the things that went wrong with the leadership of Starbucks that caused $32 billion in lossed in less than 2 years.

The Background: Who is Laxman Narasimhan? And what Qualified Him to Lead Starbucks?

Before his appointment, it’s worth asking: why him? What exactly in his background made Laxman the right pick to succeed Howard Schultz, the man who built Starbucks’ entire culture and identity?

Let’s explore it below:

Educational Background

According to Global Indian Network, Laxman’s “extraordinary background and multicultural upbringing” prepared him for a global career. Let’s break that down:

- Born and raised in India

- Bachelor’s in Mechanical Engineering (India)

- MA in German and International Studies (USA)

- MBA in Finance (USA)

A good academic path, yes … but hardly “extraordinary.” Millions of Indian students pursue engineering degrees every year. The only unusual element here is his major in German Studies, which might make sense for a diplomat, not necessarily for the CEO of an American coffee giant.

Multicultural upbringing? He was born, raised and educated and lived in India for most of his life. So, nope.

Now, let’s look at his professional experience.

Professional Experience

Laxman’s professional career began at McKinsey & Co. India, where he spent 19 years climbing the ladder to Senior Partner. His work there focused on shopping, consumer insights, retail, and tech practices. In short, a lifetime consultant. Someone who advised others how to run companies, but never actually ran one himself.

He then moved to PepsiCo, where he became CEO of Pepsi Latin America, Europe, and Sub-Saharan Africa. So far, still no U.S. market experience, an important detail for someone later expected to lead an American coffee empire.

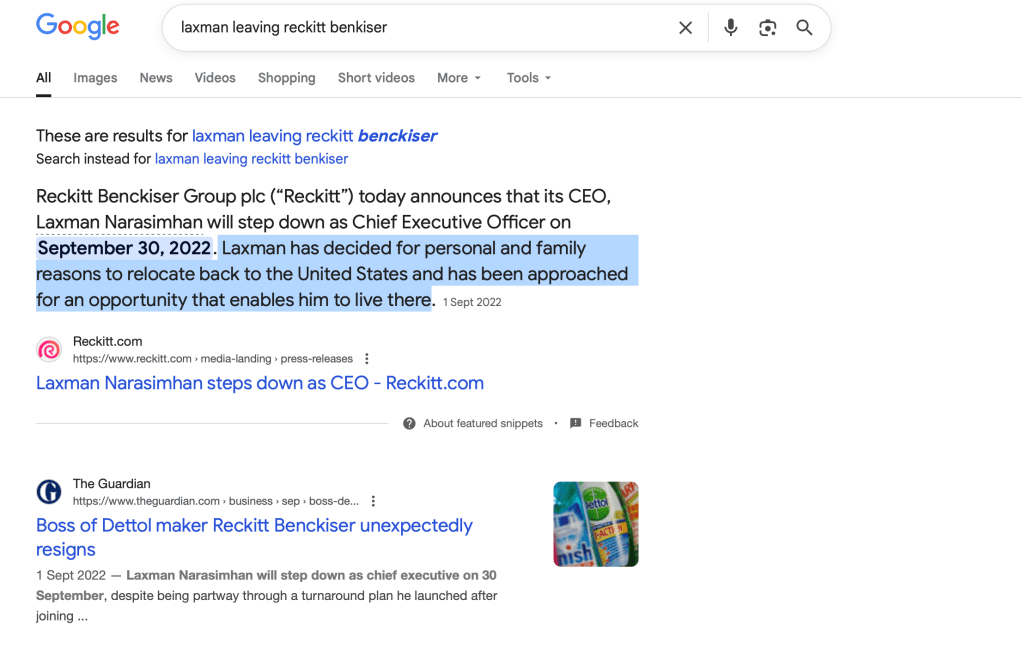

On September 1, 2019, he moved to the UK to succeed as CEO of Reckitt Benckiser, a conglomerate best known for consumer and cleaning brands like Vanish, Retool, Veet, and Durex.

On September 1, 2022 it was announced that Laxman will step down due to his personal choice to explore opportunities in the USA. The company said this news came as a surprise to them, and it caused a 4.5% share drop that week. Sounds like a pretty selfish move to me.

“Laxman has decided for personal and family reasons to relocate back to the United States and has been approached for an opportunity that enables him to live there.” – The Guardian UK

Laxman starts his first 6 months as CEO working as a barista in Starbucsk stores

In October 2022, Laxman became CEO of Starbucks, succeeding Howard Schultz.

And what did he do in his first six months? He worked shifts as a …. barista in Starbucks stores. I’m not even kidding. Here’s a photo:

That move raised eyebrows everywhere. And it still does.

The newly appointed global CEO “learning the ropes” by making lattes? That’s not inspiring, it’s alarming. It signaled that this guy had no operational understanding of the business he was supposed to lead with vision.

That last move raised eyebrows. Why would a newly appointed global CEO need to “learn the ropes” by making lattes? Symbolic humility? Maybe. But it also revealed a fundamental lack of operational familiarity. Not a great sign for someone tasked with steering a $100B global coffee empire.

What Went Wrong? A McKinsey Consultant Running a Global Coffee Chain

Or better to ask: How could have this gone right?

Here’s the real problem: Narasimhan had never run a coffee chain.

He came from nearly two decades in corporate advisory, not operational retail. Running a coffee empire with 30,000 stores across cultures and continents needs an entirely different skill set, one you don’t learn from PowerPoint slides or a six-month barista training.

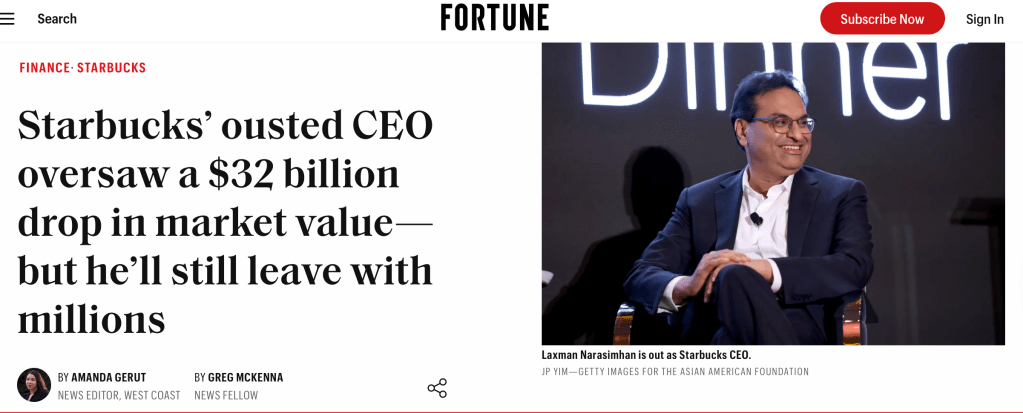

During his tenure, Starbucks lost over $32 billion in market value, and worth to note this was after the pandemic. So no, they can’t blame COVID or global boycotts.

By August 2024, less than two years into the role, he was quietly ousted by the Starbucks board, and walked away with a reported $17 million severance package.

Why Was He Fired?

Officially, Starbucks called it a “mutual agreement.” But the timing and his massive exit package told another story. It looks like he was forced to leave ASAP and even given severance pay to exit.

The truth? Declining sales, angry investors, unhappy customers, and a frustrated board. External pressures like boycotts may have played a part, but the core issue was poor leadership, lack of customer understanding, and misplaced priorities.

And the irony? After 19 years advising companies on “strategy,” Narasimhan himself had no clue how to execute one. In my opinion, he was simply self-serving, taking the opportunity for personal gain, just as he left his previous employer mid-crisis.

Loyalty Lost: How Starbucks Alienated Its Best Customers

Perhaps the biggest mistake he made was alienating the most loyal Starbucks customers.

Starbucks’ loyalty program was one of the best in the industry, every 10th drink was free, and you could redeem rewards for any beverage on the menu. It felt generous and rewarding to be a Starbucks member, and people looked forward to that feeling.

Under Narasimhan, that quickly changed. The company quietly removed key membership perks: no more “10th drink free,” and redemptions points were diluted and limited to basic items like an Americano or a donut.

What used to feel like, “Oh, I’m getting a treat with my 10th purchase” became “Am I only worth the cheapest item on the menu?”

Loyal Starbucks customers noticed. Instead of feeling appreciated, they felt cheated.

Meanwhile, competitors like Coffee Bean & Tea Leaf and Luckin Coffee did the opposite. They started offering 10–50% discounts on every purchase, launching daily deals, and focusing on rewarding customer retention.

Raising prices while removing benefits was the final push for many long-time fans to switch brands in a post-pandemic situation.

The Aftermath: Brian Niccol and the Return of Retail Reality

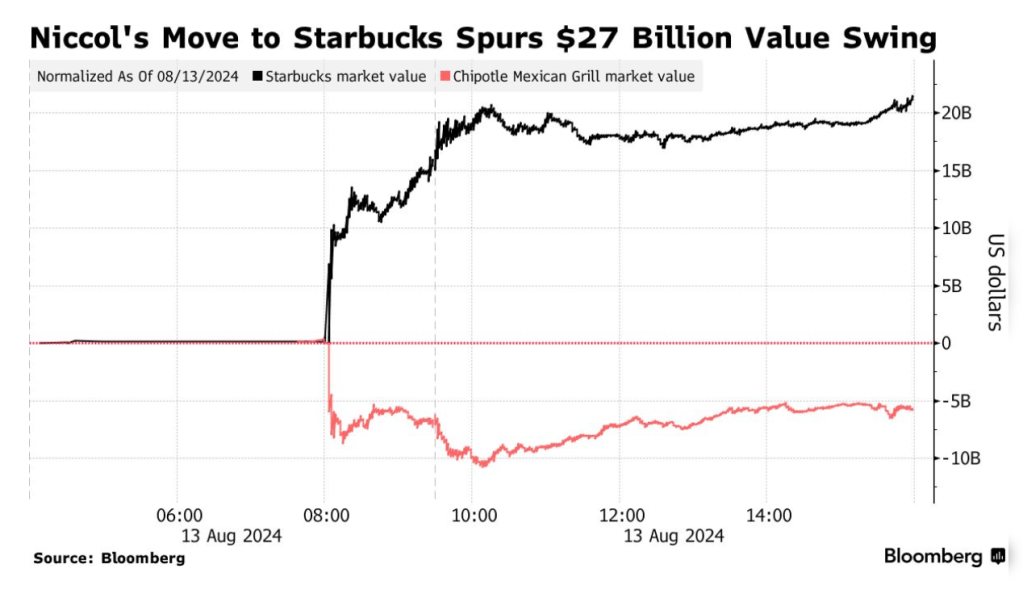

When Brian R. Niccol, the former Chipotle CEO, took over as Starbucks CEO in September 2024, the market cheered. Niccol had a track record of operational turnarounds; he knew how to simplify menus, speed up service, and win back value-conscious customers. Niccol also vows not to increase menu prices, despite a 30% increase in operational cost.

Within days of the announcement, Starbucks’ market capitalization surged by $27 billion (source: Bloomberg). Analysts described it as “the return of an operator who understands the customer.”

The message was clear: the market values competence more than corporate credentials.

Meanwhile, Starbucks Continues to Struggle in China in 2025

Nowhere was Starbucks’ decline more visible than in China, its second-largest market after the U.S.

For years, Starbucks was seen as a status symbol, a sign of sophistication and a Western lifestyle. But that image collapsed quickly.

Meanwhile, Luckin Coffee reshaped the Chinese coffee market with:

- Drinks as cheap as ¥9.99 = $1.40 USD. In constrast, a cappuccino at Starbucks China costs about ¥36 or $5.06 USD)

- 100+ beverage menu options

- Daily promotions and app-based loyalty discounts

- Fully digital ordering, tailored to local payment habits (China has 80%+ mobile payment users)

While Luckin is leading China’s coffee price war, competitors like Cotti Coffee followed, creating a mental ceiling price of ¥9.99. As a result, Chinese consumers have become more price-conscious.

In contrast, Starbucks stuck to premium pricing and slow adaptation.

By 2025, Starbucks’ China sales were down 11% year-on-year, and the company announced the sale of its China operations to Boyu Capital, effectively taking a step back from its second largest market. Other American brands that sold their China operations include KFC and Pizza Hut in 2016.

Final Thoughts

As of 2025, Starbucks is still struggling to rebuild its image and market share both on home turf and overseas. The Starbucks Report Q4 Earnings show they’re on the path to recover the -4% sales decline since the beginning of the year 2025 and moving towards closing the year with 0% growth.

But this case study leaves a timeless reminder:

Authentic leadership beats symbolic leadership, every single time.

If you liked this post, don’t forget to check out: “Why Starbucks Failed In Australia?“